I’m not sure if what I’ve seen over the past 10-12 months could necessarily be called a trend, but it is interesting to me that during those few months so many multipurpose (some call them sport/rec) and utility-type side-by-sides have been released.

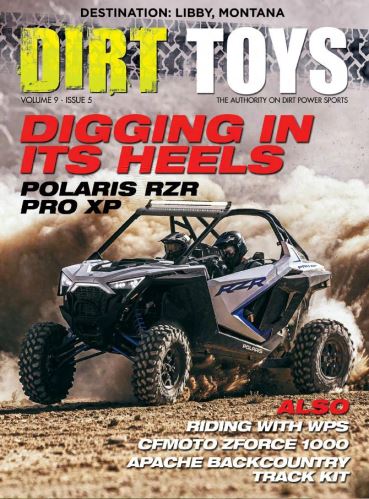

It’s interesting because if you’ve been paying attention to the market, the hottest segment has been the sport/high performance segment that includes the likes of Polaris RZRs, Arctic Cat Wildcats and Can-Am Mavericks that have been grabbing a lot of attention.

Yet, it’s the multipurpose segment which has grown bigger this year with the addition of several vehicles and the year, as I write this, is only half over. Yamaha added to its Viking line, Honda its Pioneer line and KYMCO its UXV line, which are among some of the highlights over the past several months. Then there’s the Kawasaki Mule, which Kawi unveiled with a fair amount of fanfare earlier this summer in Nebraska.

And there is more to come I’m sure as the rest of the year unfolds. I already have a couple of invitations to more new model unveilings.

I could easily get stuck in the quagmire of definitions for each of the side-by-side classes but that’s not my purpose this time. So generally speaking, the sport segment includes the high performance vehicles. Multipurpose would be vehicles that can work and play, while utility vehicles are low-speed and strictly designed for the jobsite or farm.

On the border between the sport/multipurpose segments are the likes of John Deere’s Gator RSX850i, the Kawasaki Teryx and Can-Am’s Commander line.

But I digress. I’m here to talk more about trends than where each model falls in a lineup.

So what is driving this multipurpose mania? Listen to any number of media intro presentations and you’ll hear just about the same thing: the multipurpose line is still the largest segment in the side-by-side market.

It’s difficult to get hard numbers on the exact sales of each segment: sport vs. multipurpose vs. utility. Those are closely guarded numbers. We occasionally see percentages of market share and overall numbers, but nothing real specific.

Here are some general figures I have seen in the past year. The multipurpose segment of the side-by-side market is about 46 percent while the sport/high performance segment is 34 percent and utility 20 percent. In another presentation, sales of multipurpose side-by-sides were projected to be roughly 150,000 units from late 2012 to early 2014. In that same time period, the sport segment was 55,000 and the utility segment 100,000. So those don’t quite match up with the percentages I saw in the other presentation but then I don’t know exactly which vehicles were represented in each presentation. That’s where the vagueness of all this comes into play.

However, I think it is safe to say that the multipurpose segment is the largest of the three and, according to the one presentation I saw, should continue to grow modestly over the next few years.

About the best information I’ve seen recently on the size and particulars of the market comes from a Specialty

Equipment Market Association (SEMA) report that was just released. There is so much information in that report that there’s not room enough for it here so I’m going to give you some highlights. As a matter of reference, SEMA’s segments—sport, multipurpose and utility—are basically the same as what I mentioned earlier.

– Approximately 670,000 UTV models were sold in 2010 to 2012.

– About 82 percent of owners have purchased or plan to purchase upgrades to their UTV. More than 410,000 households in the United States buy UTV accessories.

– When accessorizing, UTV owners are often focused on safety over speed, durability over performance and practicality over excitement. The most popular upgrades of hitch balls, tow hitch receivers and rearview mirrors reflect these priorities. Okay, this one really surprised me but the report backs up SEMA’s findings.

– Sport models are the most accessorized. Sales of this type of UTV are more common in the West and owners of these vehicles are more social, often riding with passengers and in groups.

– Multipurpose vehicles comprise the largest segment of UTV sales with the highest volume in the South. Owners seek ultimate versatility with their vehicles and their modifications.

– Utility model sales are strongest in the South and Midwest. Owners perceive and use their UTV as a tool, focusing on practicality and durability. They are the least likely to upgrade their vehicle and are the most solitary, frequently driving their UTV alone.

2012 Regional Segment Sales

South - 44 percent

• Sport - 17 percent

• Multipurpose - 46 percent

• Utility - 38 percent

Midwest - 27 percent

• Sport - 14 percent

• Multipurpose - 49 percent

• Utility - 38 percent

West - 21 percent

• Sport - 45 percent

• Multipurpose - 36 percent

• Utility - 19 percent

East - 8 percent

• Sport - 22 percent

• Multipurpose - 39 percent

• Utility - 39 percent

– Texas has the highest level of UTV sales, followed by California and then Ohio.

There is much more in the SEMA report that I just don’t have room for right here. So, I’ll continue to share the information in future issues of Dirt Toys.

But after looking through the SEMA report, it’s easy to see why there is so much attention being paid to the multipurpose segment.