Still riding the wave of a recent marketplace shift, the utility task vehicle, better known as the UTV or side-by-side, is at a major crossroads. Intensive growth in product development and surging sales have helped the side-by-side to become a new staple in the off-road community.

The Long (Dirt) Road To Today

The term UTV covers several different types of vehicles, but generally, all are designed for off-road activity. The mainstream use for a UTV has been more commercial than recreational. The original UTVs were vehicles that were not necessarily fast or fun to drive but were handy enough to get the job done and versatile enough to tackle a variety of tasks.

Since the early ’00s, products such as the John Deere Gator, Kawasaki Mule and Polaris Ranger have been used on job sites, moving heavy objects and transporting crew. Once their durability and overall effectiveness became apparent, UTVs began to make their way into consumers’ hands—mostly for use on farms and other functional pieces of property. According to Greg Boeder of Power Products Marketing, a website aimed primarily at powersports dealers, the utility-focused side-by-sides served as a foundation for the UTV market to grow.

“The pure utility market has always been there, without much exception,” he said.

Even in today’s market, utility-focused vehicles outsell recreational ones by a wide margin. It is only more recently that consumers have embraced UTVs aimed at sport riding in off-road terrain, especially in western states such as California.

That transition came once UTV manufacturers saw that consumers were interested in a more versatile machine that was both able to complete a job and still be suitable for recreational use. Out of those desires came the Yamaha Rhino, which entered the market in 2004. Boeder noted that the Rhino was a breakthrough in terms of being multi-purpose.

“The Rhino was the first machine that was more focused on the recreational market; it refocused what UTVs could do and how they were perceived,” he said.

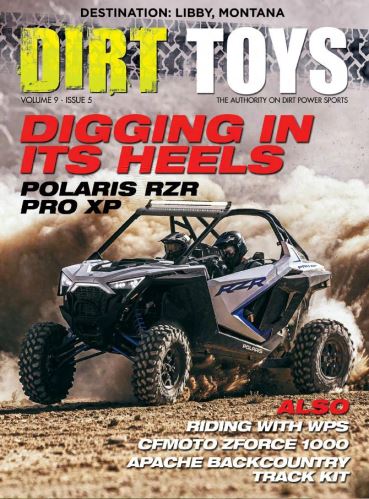

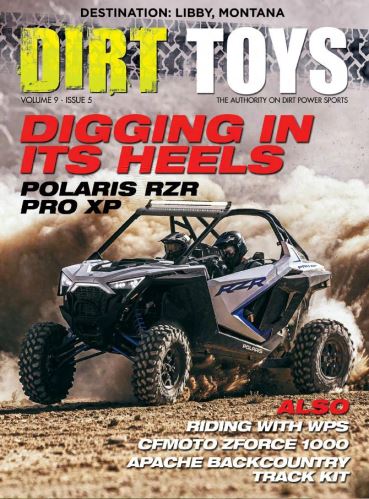

That notion resonated with consumers and furthered demand for a machine that was equal parts capable and fun—evolving toward a sports UTV. Hearing that cry from the market, Polaris introduced the RZR in 2007. It became a wildly successful side-by-side that brought to the market an entirely new generation of UTV enthusiasts that was focused primarily on off-road motorsports.

“The RZR was the first side-by-side to offer a 50-inch width, which made it trail legal across the vast majority of the country,” said Boeder. “It was the first UTV that met this requirement, making it an obvious standout pick for consumers. The dimensions, paired with a larger and lower-mounted engine, meant that the RZR was a pleasure to drive off-road and could be driven fast for long durations.”

From its first year of sale, the RZR sat atop the sports UTV market and is still largely the go-to choice for many off-roaders. As the RZR’s prominent stake in the off-road market grew, traditional vehicles—such as sandrails—lost market share.

Matt Emery, editor of Dirt Sports & Off-Road magazine, has spent years in the UTV market, focusing specifically on the sport-focused vehicles.

“If you went to any major off-road show even five years ago, everything was a race-spec sandrail,” he said. “Those huge machines cost sometimes hundreds of thousands of dollars and were purpose-built to race with massive Chevy LS motors. Now what you see at shows has completely switched over to UTVs. The market has shifted—and it has done so dramatically and quickly.”

The Aftermarket Gets Involved

According to Power Products Marketing, the market has grown each year by tens of thousands of units sold—the only exception being 2008–2009, when the recession caused a slight decline. In 2000, the UTV niche sold approximately 100,000 units across the board. Fifteen years later, that number quadrupled, with more growth anticipated in the future.

It is clear that the market is healthy and viable, especially in looking at class leaders such as the Polaris RZR, which tripled its sales between its first year on the market in 2007 and 2015. As enthusiasm for side-by-sides grew, so did interest in quality parts and accessories.

To find out more about the UTV customer base, we talked to Ron Seidner, owner of Bert’s Mega Mall in Covina, CA. The powersports dealer is said to be the single largest in the world by volume and has served the California market for decades. Seidner maintains a large inventory and generally has no fewer than 100 vehicles on the showroom floor at any given time.

“UTV is absolutely huge for us,” he said. “It is one of the ‘big three’ highest-selling categories—the other two being watercraft and motorcycles.”

Bert’s moves thousands of UTVs each year and has watched its customer base become more and more loyal to the niche.

“There really is a family component to this,” he said. “Especially here in California, the UTV market is almost entirely sports based. You have these guys come in who want to take the family out to the desert on the weekend and keep them safe in the process. UTVs are perfect for that because they are largely super reliable and capable of almost any off-road terrain.”

One of the key factors in the success of Bert’s Mega Mall is catering to customers’ desire to make their UTV bespoke. Two years ago, Seidner opened BMM customs, Bert’s in-house UTV customization department, which is capable of making just about any stock UTV into a one-off special.

“Sometimes it really is just simple tweaks here and there,” Seidner said. “A customer will want an aftermarket four-point harness installed or a lowered, reinforced cage with a light bar added—just easy additions. On the other hand, some people go completely over the top and customize their ride with everything imaginable, from new paint to bigger wheels and tires, even custom interior work. Regardless, we saw customers wanting aftermarket additions, and keeping the purchase and installation process completely in-house makes things easier on everyone.”

Emery echoed Seidner’s observations about consumers’ desire to add aftermarket componentry.

“These things are still being bought by racing enthusiasts who want their machines to look and perform as well as possible,” Emery said. “In many cases, they are ordering the cars to the spec they desire, even if that involves aftermarket work.”

Emery specifically cited the UTV racing community as one of the biggest catalysts for modification.

“Racers are adding forced induction to the motors, although that isn’t necessarily mandatory because the cars are so powerful on their own,” he said. “More often, they are adding bigger wheels and tires and swapping out suspension components as needed.”

He concluded by stating that the need for quality aftermarket parts is abundant, and aftermarket manufacturers are meeting that demand with an array of products to choose from.

Recent Changes Create a Highly Anticipated Future

Consistently rising since the early ’00s, the UTV market still seems to be gaining momentum. In October of 2016, Polaris, maker of the segment-leading RZR side-by-side, announced that it would be acquiring retail giant Transamerican Auto Parts, owner of off-road retail chain 4Wheel Parts.

Asked why the acquisition would make sense, Transamerican Auto Parts President and CEO Greg Adler said, “Our focus is off-road performance aftermarket products and accessories, while Polaris’ core business is as a manufacturer. There are many areas where our customers intersect, such as an RZR owner who is likely to use a truck for towing or transporting the vehicle.”

Meanwhile, in March, multi-industry powerhouse Textron announced the acquisition of Arctic Cat, viewing it as an opportunity to add side-by-sides and related off-road vehicles to such well-known Textron brands as Cessna, Beechcraft and Bell. In May, Textron underscored its commitment to its new acquisition by moving Arctic Cat engine production, and adding 50–100 jobs, to its St. Cloud, MN, engine plant.

“Arctic Cat is an ideal fit with our growing range of off-road recreational vehicles,” said Textron President and CEO Scott Donnelly. “The addition [instantly] gives us a deeper product line for customers, greater potential for innovation, and introduces new sales opportunities for our combined worldwide dealer network.”

For market watchers such as Emery, it is difficult to predict what may happen next.

“It will be interesting to see how the manufacturers combat increased productivity from others,” he said.

Emery’s thoughts seem to represent the consensus within the UTV industry when considering the future. Perhaps for the first time ever, industry leaders such as Polaris and its RZR are being challenged by newly designed vehicles from Can-Am, Yamaha, Arctic Cat and others. In fact, Arctic Cat used the SEMA Show as an opportunity to operate a demo track that showcased the upcoming Arctic Cat Wildcat X model.

“It’s a product we developed through a partnership with Robby Gordon,” said Greg Williamson, Arctic Cat’s chief marketing officer. “He helped us with our suspension and performance, and we put it on our new Wildcat X. The product itself is very high engagement and super experiential, so there is no better way to convert someone to our brand than to put them behind the wheel of one of our machines.”

Whether this stiffening competition will shift sales away from the Polaris brand or perhaps add to total market volume remains to be seen. That said, optimism is high across the board, and the UTV niche looks to be growing healthier in almost every measurable aspect.

“The UTV market is really just getting started,” Seidner summed up. “Much like everyone else, we are very excited to be part of its future.”

Emery agreed: “I think it is safe to say we are all eagerly anticipating what is to come.”