It’s been a long hot summer’s day and you’re sitting in your dusty truck trying to cool off as you finish checking your irrigation water. It’s bad enough that you’re tired, dirty and dusty, but the inside of your new truck looks like half your field is going home with you.

You know that even when your work is done, you’re going to spend another hour just cleaning up your vehicle for normal driving. You wish you could afford something else to use on the bumpy dirt roads of your farm, but in today’s economy, you’re doing all you can just to pay your bills.

You’ve had your eyes on some of those ATVs down at the local dealer, but until you win the lottery, toys will just have to wait for better days.

This may sound familiar to many, but if you have a good tax accountant you just may find that it is easier than you think to afford a new ATV or side-by-side to use on the farm … especially if you end up sending a check to Uncle Sam at the end of the year when you pay your taxes.

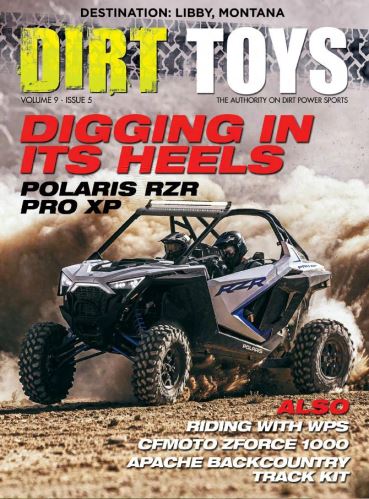

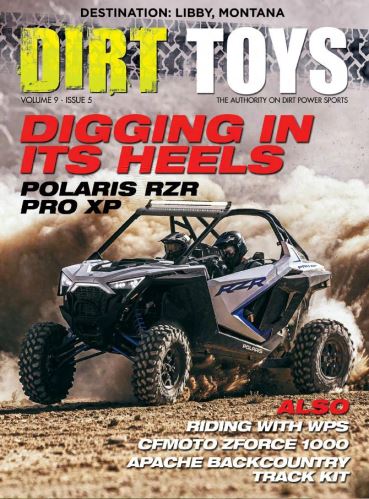

ATVs and side-by-sides may seem like toys to many, but to farmers and ranchers they can represent the perfect utility vehicle to get you around the dusty/muddy farm roads and out to your crops and animals.

Good Investment

For a fraction of what you pay to replace your truck, you can turn work into pleasure as you ride out to change the water on an ATV. Not only are they cheaper to buy and represent less wear and tear on your full-size vehicle, all of their cost can also be written off your taxes.

Just exactly how much is saved is determined by your income and how you itemize them in your expenses. But with a good accountant and proper planning, you could save up to 60 percent of the value of the ATV or side-by-side in tax savings.

If you are in the highest tax bracket in the United States and own your own business and file as a sole proprietor, the least amount of taxes you pay on your net income is 54.9 percent. Let me repeat that again. The least amount of taxes that you are going to pay is half of what you make. I get this figure by adding 39.6 percent rate for your federal income tax and 15.3 percent for your self employment tax. You still have a lot of miscellaneous taxes not included with these two big ones (state income tax, sales tax, fuel tax, etc.) that will bleed your potential earnings.

So sit back and think how great it would be if the government paid for half of your next ATV or side-by-side. That is a great concept. And on the farm there are hundreds of practical uses for an ATV that can even make the work more bearable … especially on a warm summer day.

An ATV can get you to your pivots with less impact on the soil. And if you hit that big mud puddle in the middle of the farm, your pickup is still clean when you go to town to pick up the parts for the equipment on the farm.

Lots Of Uses

In the winter you can use your ATV or side-by-side to plow snow quickly. It can tow small trailers, weed sprayers, etc., allowing you to get into tight places with ease.

And the fun side of one of these vehicles is when you take it to the top of the mountain where you can look down on your farm to make sure everything is running as it should. You get to enjoy the scenery, the fun ride and knowing that the government paid for part of the side-by-side that you are riding.

Here’s how the numbers can break down in a basic scenario: Let’s say you bought a nice new side-by-side for $15,000 to work the farm in 2013 (these numbers will vary slightly in future years just because the tax code is constantly getting revised). If it was the only piece of equipment you purchased, you could list it on form 4562 and then take section 179 to fully recover the cost of your vehicle that year.

The exact amount you actually save in taxes depends on the type of tax return you file and your taxable income. That can change depending on your filing status. The lowest tax bracket is 10 percent and the highest tax bracket is 39.6 percent.

Depending on the state in which you reside, these numbers can also change. In Idaho, for example, form 49 gives you a credit for machinery and equipment you purchase … but not if you use section 179 to recover the full cost.

Now we can rattle numbers and rates all day long. But the best advice I can offer is for you to get with a CPA (accountant and/or tax expert) in your own state to review your options.

The tax code is a long and cumbersome creature that can be frustrating to comprehend. It’s worth paying an expert to walk you through the system.

Don’t forget: The reason most of you own farms is because you love to do what you do—having the freedom to work your land in a manner you see fit.

It’s hard work … but sometimes the little things can make the work much more pleasurable. And busting through mud on a hot summer’s day can be a blast if you’re riding the right vehicle.